Starting and growing a business can be expensive, but luckily there are a number of trusted banking companies that offer a business loan to help get you off the ground. We rounded up four of the top business loan providers in Singapore. Read on to learn more about each company and find the best one to partner with for your funding needs.

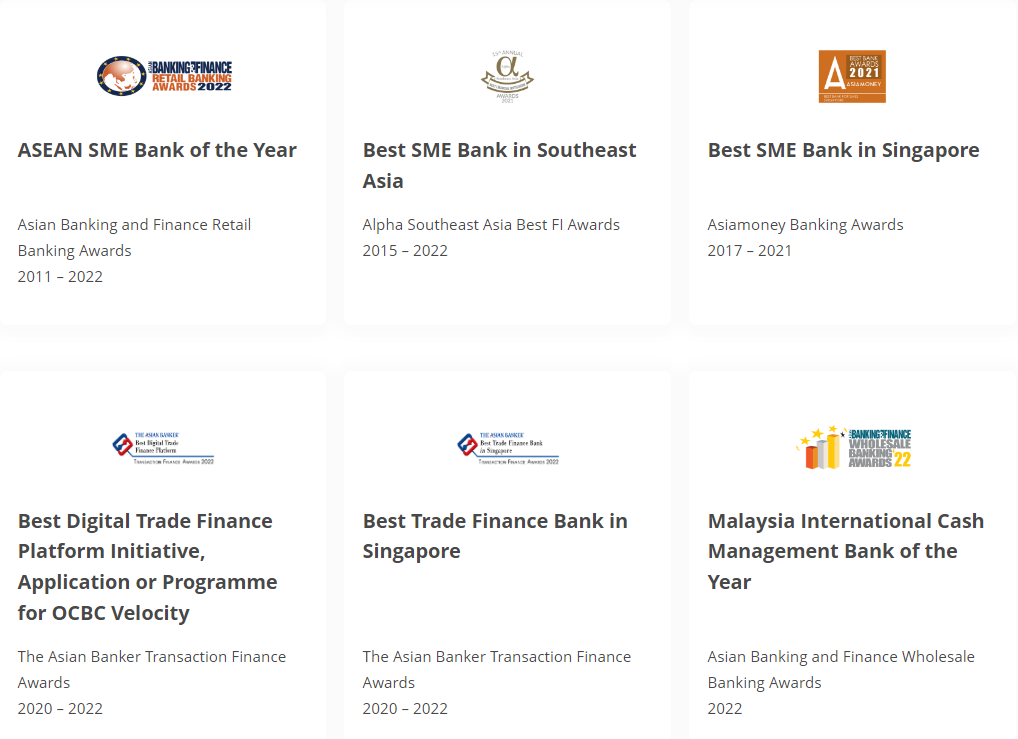

1. DBS

Website: DBS SME Banking

Assistance offered: Business loan up to SGD 500,000, up to 5 years to repay

DBS business loan funding is open to all businesses, including companies that don’t qualify for government-assisted loans. This means that any SME or startup business can access the funding they need to grow its business.

In addition, company loans offered by DBS come with repayment terms of up to 5 years, so business owners can tailor their repayments to fit their cash flow. A DBS SME business loan is a great way for small businesses to get the funding they need to grow and thrive. See how DBS helped Good Dog People transition to an online business despite the challenges of the pandemic:

This video is taken from “DBS youtube channel”

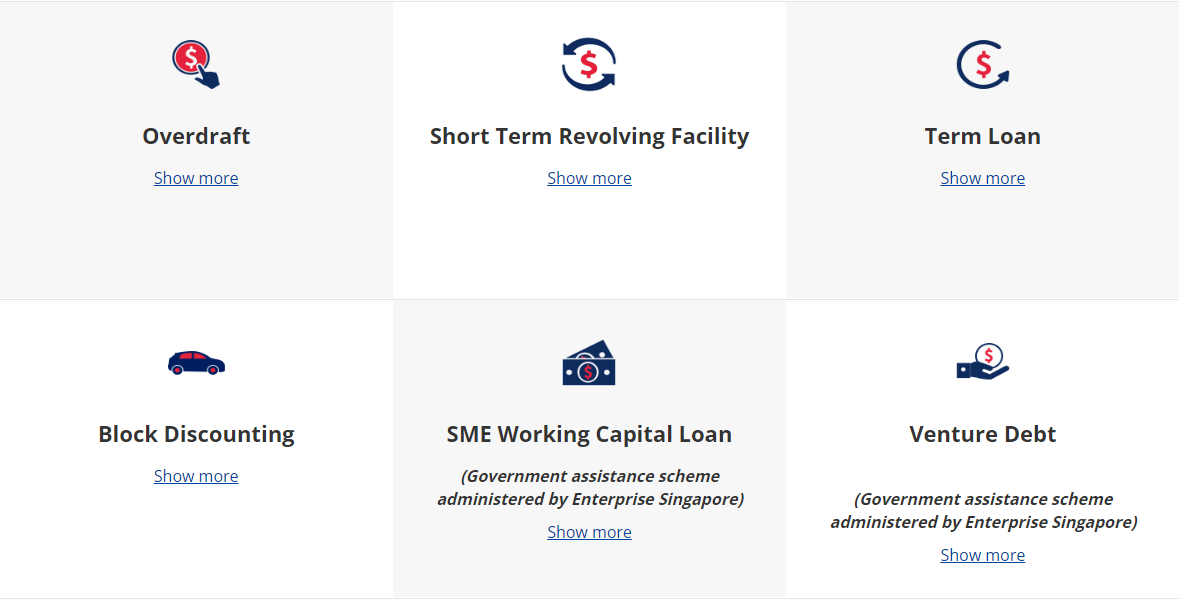

2. OCBC

Website: OCBC SME Loans

Assistance offered: Up to SGD 100,000 for startups over 4 years with no collateral needed, other business loan offers are available here

OCBC Bank’s business loan offers are designed to help company owners finance their everyday business needs. Whether you’re looking to purchase new equipment, expand your business, or venture into new industries, OCBC has a financing solution that’s right for you.

With competitive interest rates and flexible repayment terms, OCBC Bank’s capital loans and small business loans can help you take your business to the next level. And because every business has different financial needs at any stage of their growth, they offer a variety of small business loan products that can be customised to meet your specific needs.

3. UOB

Website: UOB Comprehensive Financing Solutions

Assistance offered: Working capital loans, asset-based financing, project financing, and more

UOB Corporate Banking offers a comprehensive suite of business loan products that can provide the financing your company needs to support its everyday operations or future expansion plans. Their financing solutions are designed to meet the unique needs of SMEs and corporate clients, and their experienced team of bankers will work with you to tailor a loan package that meets your specific business loan requirements.

So if you’re looking for a partner who can provide innovative SME loans and financial solutions to support your business, look no further than UOB Corporate Banking. Here are the features of UOB’s working capital SME loans that can help you kickstart your business’s success.

4. Maybank Singapore

Website: SME Loans

Assistance offered: Government assistance scheme, fixed asset financing, working capital funding

Maybank offers a competitive SME loan in Singapore to help small local enterprises and start-ups gain easy access to financing.

The bank offers several types of business loans, each designed to meet the specific needs of SMEs. The government’s assistance business loan provides funding for startups or expansions, may it be local or international. Fixed asset financing helps businesses to purchase equipment or property to help their processes be more efficient and up-to-par with competitors.

Their working capital loan for companies can be used for day-to-day expenses such as rent, salaries, and inventory. Maybank Singapore is committed to supporting SMEs, and business owners can be assured of finding a loan product that meets their needs.

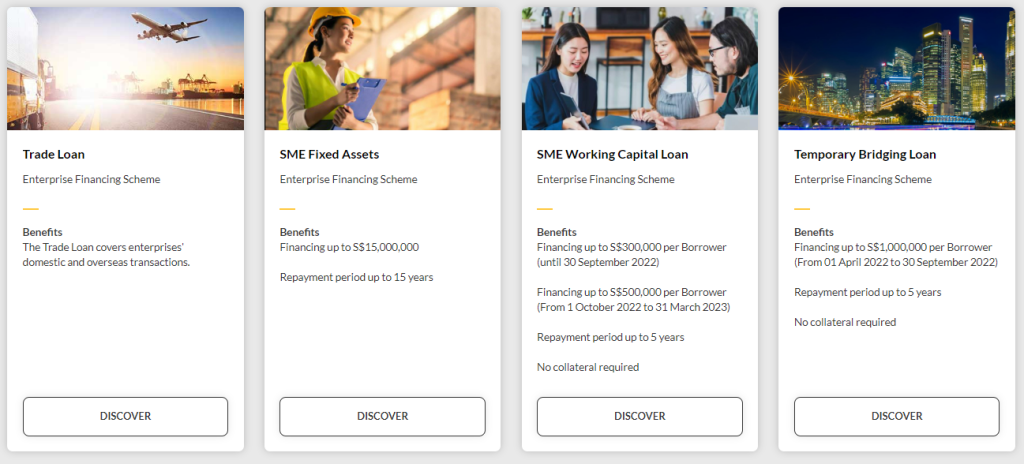

Their government assistance scheme covers the following services, and there’s more than that Maybank can offer to support SMEs and growing businesses such as yours:

Conclusion

If you are in need of a business loan, one of the top four companies CLDY listed should be able to help you out. Each company offers different services and terms, so it is important that you do your research before applying for a loan. We hope that this article gives you an idea of what to expect when borrowing money for your business and points you in the right direction as you expand your business locally and internationally.