A corporate banking account is one of the most essential things to set up when you first start a business. It allows you to keep track of your finances and helps you secure your financial future.

It’s a good idea to research and compare different corporate banking options before making a decision. To help you out, CLDY has compiled a list of the top five corporate banking institutions in Singapore.

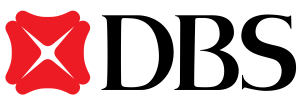

1. DBS

Website: https://www.dbs.com.sg/corporate/default.page

Corporate Services: Cash management, import and export financing, equity capital market, project financing, and more

Every business is different. That is why DBS offers a comprehensive suite of corporate banking solutions to meet your specific needs. DBS corporate banking solutions include supply chain financing, digitalisation plans, cash flow management, and more services to take your financial management to the next level.

The DBS corporate business banking network currently operates in 18 markets throughout the world—mainly in Southeast Asia, Greater China, and South Asia. Register for a DBS corporate account now and see what more they can offer.

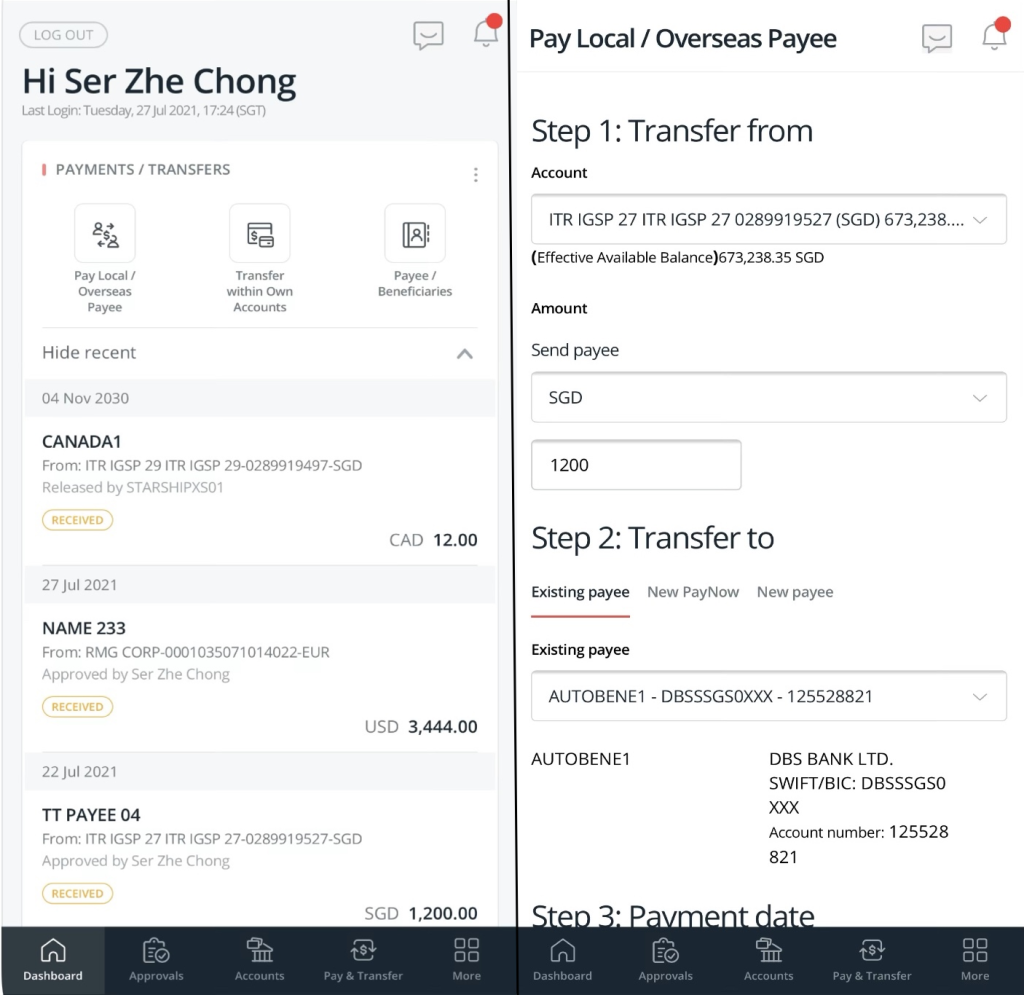

2. United Overseas Bank (UOB)

Website: https://www.uob.com.sg/business/

Services: UOB business accounts, working capital loans, business property & equity loans, business insurance, and more

UOB corporate banking solutions are designed to help businesses of all sizes operate more efficiently.

From corporate lending and trade financing to foreign exchange and treasury management, they offer a wide range of UOB business banking services that can be customised to meet your specific needs.

UOB’s experienced team of corporate bank managers are on hand to provide advice and support, ensuring that you have all the tools you need to grow your business.

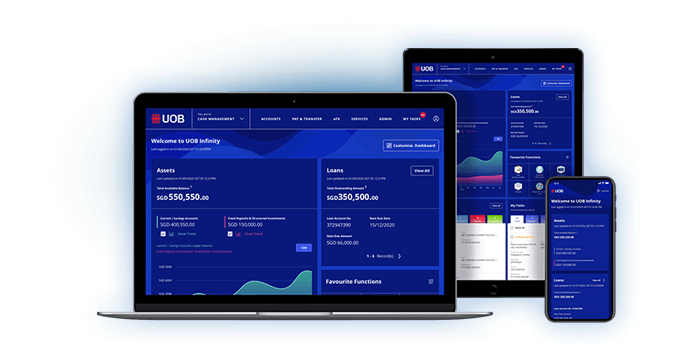

Take a peek at their online banking platform here:

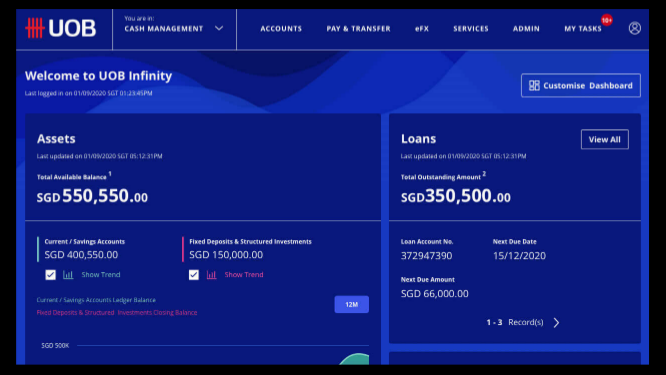

3. OCBC Bank

Website: https://www.ocbc.com/business-banking

Services: Business account, trade financing, SME sustainable financing, treasury services, investment banking, and more

As an entrepreneur or small business owner, you know that time is precious. There are always a million things to do and never enough hours in the day.

That’s why having an all-in-one bank account is the dream for many business owners. With OCBC Bank’s corporate banking solutions, you can streamline your financial operations and focus on what’s important: running your business.

The OCBC corporate banking platform comes with a cash flow management tool and an e-invoicing tool, so you don’t need to manage these transactions on another application. You can also link your business banking account to your Xero platform, keeping the wheels of your business running with minimal work on your end.

4. CIMB Bank

Website: https://www.cimb.com.sg/en/business/home.html

Services: Cash management, loan and financing, trade finance, treasury services, and more

CIMB corporate banking Singapore offers a wide range of solutions for businesses of all sizes, so you can find the perfect fit for your company. If you’re on the first steps of your business, get started with CIMB business banking tools for cash flow management, payment gateway for online transactions, and insurance options as well (because it’s never too early to get your business protected).

If your business is already in the corporate scene, CIMB has a full suite of one-stop corporate banking solutions that will set you up from collections and cash management accounts, import and export trades, to forex trading and credit facilitity.

So, whether you are a startup or an established enterprise, you can count on CIMB business banking to support all your corporate banking needs.

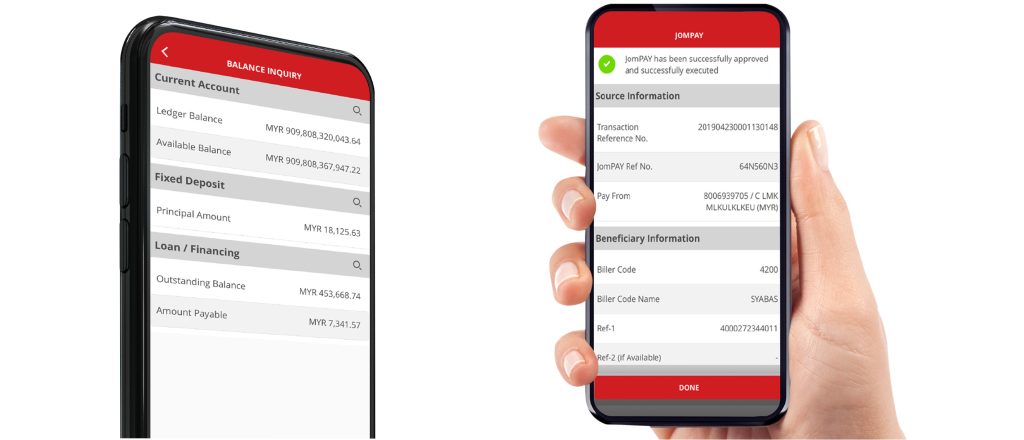

See how easy it is to manage your corporate banking account with CIMB’s mobile app:

Images are taken from the “CIMB” site

5. HSBC

Website: https://www.business.hsbc.com.sg/

Services: Account opening, financing for SMEs, access to cash, trade, and foreign exchange specialists, and more

HSBC corporate banking services are designed to provide support for small-to-medium enterprises (SMEs) looking to grow their businesses. With more than 140 years of experience in Singapore, HSBC has the global connections and expertise to help your business succeed.

Their digital banking solutions for businesses offer more than just transactional services. They can help you with a range of corporate banking needs, including working capital, financing, foreign exchange, and more. Whether you’re just starting out or you’re ready to expand into new markets, HSBC can provide the support you need to help your business reach its full potential.

Images are taken from the “HSBC” site

Conclusion

So there you have it, our top five picks for the best corporate banking institutions. Each of these banks has something unique to offer businesses of all sizes and industries. We are confident that you will be able to find the perfect fit for your business.